Scroll to:

Third-Party Payment Regulation: Analysis of Risks and Legal Mechanisms in China

https://doi.org/10.21202/jdtl.2025.11

EDN: kxekjy

Abstract

Objective: to identify the main risks and problems in the field of third-party payments in China; to analyze the current legislation on the regulation of this sector; and to propose scientifically sound ways to improve the effectiveness of regulation of such payment systems.

Methods: the study used a set of general scientific methods, including analysis, induction and synthesis. The authors comprehensively analyzed the current state and legal regulation of third-party payments in China in order to develop practical recommendations for the introduction of effective regulatory mechanisms in this area. A comparative-legal analysis of existing regulations and international experience in regulating financial technologies was performed.

Results: it was found that third-party payments have become an integral part of e-commerce, effectively solving the problems of high transaction costs and shortage of credit resources in Chinese e-commerce. The analysis showed that the payment industry is facing serious challenges, including insufficient regulation, financial and technological risks. The authors revealed a market competitive structure according to the “2+1+N” model with the dominance of large payment platforms. Practical recommendations were developed to improve legal mechanisms ensuring the stability and security of the third-party payments sector, including the creation of a single regulator and increased supervision of deposited funds.

Scientific novelty: the study complements the scientific base in the field of financial technology regulation, systematizing the main risks of the third-party payments sector and analyzing the modern regulatory framework. It takes into account the latest changes in the industry, which allows the authors to form a comprehensive understanding of the legal challenges in this area. For the first time, an integrated risk assessment model for third-party payment systems was proposed.

Practical significance: the findings have practical implications for improving regulatory efficiency, which is relevant both for third-party payment service providers and for financial regulators when developing policies in the field of financial technology and digital payments. The results can be used to improve the legislative framework and create specialized financial supervisory authorities.

Keywords

For citations:

Jingrong L., Jigeer Sh. Third-Party Payment Regulation: Analysis of Risks and Legal Mechanisms in China. Journal of Digital Technologies and Law. 2025;3(2):259-274. https://doi.org/10.21202/jdtl.2025.11. EDN: kxekjy

Introduction

Third-party payment refers to a payment service provided by a non-banking institution for fund transfer, payment and settlement through the Internet or mobile devices (Liu et al., 2020; Thakor, 2020; Fan et al., 2023). With the development of financial technologies and the rise of e-commerce, third-party payment has expanded decisively and serves as an essential component of the financial system. In China, the competitive pattern in the payments industry can be summarized as a “2+1+N” structure: Alipay and WeChat Pay account for nearly 60 % of transactions; UnionPay provides key clearing and settlement services; and a few third-party licensed payment companies are competing for market share in this field. The proportion of China’s online payment users compared with all Internet users has remained steady at approximately 85 percent in 2022.

Payment by third parties have been advantageous for both the economy and society. A major aspect of e-commerce is currently involving third-party payment by effectively solving the problems of high cost and lack of credit in e-commerce (Tang et al., 2021; Zhao & Sun, 2012; Qiu, 2025). Third-party payment is becoming increasingly important in the payment system, and the potential risks brought by new technologies and business models have put forward higher requirements for regulation. This work investigates the potential risks associated with third-party payment by reviewing the relevant regulatory framework, and proposes possible solutions to improve the effectiveness of regulation.

1. Development status and regulatory framework of third-party payment

1.1. Current development status of third-party payment

There is no standardized definition of third-party payment. In the particular case of China, the exponential development of e-commerce is a prerequisite for the introduction of third-party payments. For e-commerce, electronic payment is an essential and vital instrument. The emergence of the third-party payment service is in line with the development of e-commerce, and is also one of the specific forms of online payment innovations. Alipay was introduced as a payment instrument for secured transactions to solve the trust issue that hindered the development of e-commerce marketplace of Alibaba (Ye et al., 2023; Du, 2025), and now it is one of the biggest payment platforms worldwide. The third-party payment service is based on large-scale online portals, and uses the credit of the banks with which it cooperates as its credit guarantee (Yao et al., 2018; Lee & Shin, 2018). In this context, third-party payment refers to a payment service provided by a non-banking institution for the purpose of transferring, paying and clearing funds via the Internet or mobile devices. Third-party payment includes online payment and offline payment. Online payment is usually used for e-commerce transactions, where users complete the payment through the third-party payment platform; offline payment is mostly observed in physical stores, where users complete the transaction through mobile devices. Figure 1 shows China’s third-party payment market share in 20231.

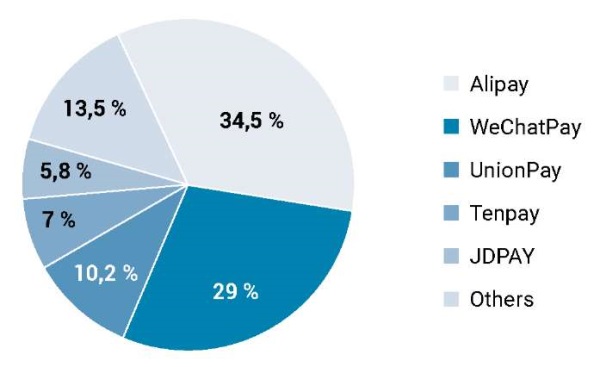

Figure. 1. China’s third-party payment market share

The data presented in Figure 1 on third-party payment market share shows that Alipay, WeChat Pay, and UnionPay ranked the top three with market shares of 34.5, 29, and 10.2 %, respectively, and the sum of the market shares of these three reached 73.7 %, indicating a high degree of concentration in the market.

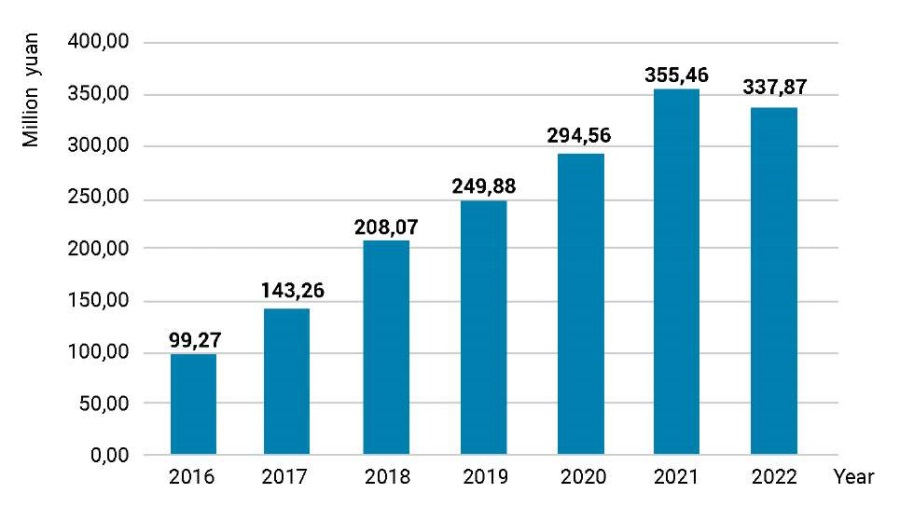

Figure 2 presents the data on the scale of third-party payment, which grew from 99.27 trillion yuan in 2016 to 337.87 trillion yuan in 2022, and it is predicted that the scale of China’s third-party transactions will maintain its growth in the future, and is expected to reach 644 trillion yuan by 20282.

Figure. 2. Scale of China’s third-party payment transactions

1.2. Regulatory framework of third-party payment

Third-party payments need to be addressed by the regulation framework due to their increasing significance in the payment system and the potential threats involved. China’s third-party payment regulatory framework has a long process from absence to existence, from loose to strict regulation.

Prior to 2010, China had no clear regulatory organization and regulatory framework for third-party payment, and the third-party payment sphere was relatively unorganized, with high level of risks associated with payments. The People’s Bank of China (PBOC) as the central bank of the country promulgated the “Administrative Measures for the Payment Services Provided by Non-financial Institutions” in 2010, which states that the PBOC supervises all aspects of the third-party payment institutions’ operations, including the issuance of licenses, the continuous and stable operation of the institutions, risk management and control, risk disposal, and the withdrawal from the market. This clearly establishes that China adopts an institutional regulatory model for third-party payment institutions. Adoption of the regulation represents the commencement of legislation on third-party payment (Liu Zhaolu, 2018; Chen & Wang, 2024).

China has been emphasizing regulations on third-party payments as the sector thrives, and has successively introduced a series of legislations and regulations, including the strengthening of the entry of payment institutions, the supervision of fund security and the supervision of anti-money laundering. From 2010 to 2023, the People’s Bank of China (PBOC), the China Banking Regulatory Commission (CBRC), the State Administration of Foreign Exchange (SAFE) and other financial regulators issued many relevant regulations and legislations to ensure that the third-party payment industry operates in a stable and prudent condition. Table summarizes China’s main regulations and legislations related to third-party payments.

China’s main regulations and legislations related to third-party payments

|

Regulations |

Date |

Main content |

|

Administrative Measures for the Payment Services Provided by Non-financial Institutions |

2010.06.14 |

The document clearly stipulates that third-party payment institutions should submit applications to the Central Bank for the issuance of a license for the provision of payment services. Third-party payment institutions are obliged to meet the qualifications for registration, which raises the entry threshold, and clarifies the issue of attribution of customer provisioning funds |

|

Measures for the Supervision and Administration of Combating Money Laundering and Financing of Terrorism by Financial Institutions |

2012.08.01 |

The document emphasizes that third-party payment institutions should set up a special anti-money laundering and anti-terrorist financing department to take charge of anti-money laundering measures. Third-party payment institutions are required to verify the authenticity of users’ identities |

|

Measures for the Custody of Clients’ Reserves of Payment Institutions |

2012.06.07 |

The document clarifies the depository and use of funds in transit, and strictly bans diversion by third-party payment institutions |

|

Announcement of the China Banking Regulatory Commission on the Results of the Review of Regulatory Documents |

2014.04.09 |

The document stipulates that third-party payment is applicable to the online payment business of non-bank payment institutions. At the same time, it makes clear regulations on account management, identity verification and information protection, transaction limits and risk control, supervision and management, and penalties |

|

Notice of the State Administration of Foreign Exchange on the Pilot Cross-border Foreign Exchange Payment Business of Payment Institutions |

2015.01.29 |

The document specifies that payment institutions engaged in cross-border payment activities are subject to the supervision and administration of the SAFE |

|

Administrative Measures for Online Payment Business of Non-bank Payment Institutions |

2016.07.01 |

The document requires that payment institutions should follow the principle of mainly serving e-commerce development and providing small, fast, convenient and micro payment services. They should offer online payment services based on customers’ bank accounts or prescribed payment accounts. Meanwhile, establish and improve the risk reserve fund and transaction compensation systems to safeguard customers’ rights |

|

Notice of the General Office of the People’s Bank of China on Matters concerning Implementing the Centralized Deposit of the Funds of Pending Payments of Clients of Payment Institutions |

2017.01.13 |

The document requires that the proportion of customer reserve funds be determined by the People’s Bank of China based on the business types of payment institutions and adjusted as needed for management. Customer reserve funds are included in deposit accounts with no interest |

|

Notice of the General Office of the People’s Bank of China on Matters concerning Complete Centralized Deposit of the Funds of Pending Payments of Clients of Payment Institutions |

2018.06.29 |

The document specifies that payment institutions increase the centralized deposit ratio of payment institutions’ customer reserve funds, and requires 100% centralized deposit by January 14, 2019 |

|

Notice of the General Office of the People’s Bank of China on Matters concerning Implementing the Centralized Deposit of the Funds of Pending Payments of Clients of Payment Institutions |

2018.11.20 |

The document requires that payment institutions should cancel the remaining reserve funds accounts in commercial banks before January 14, 2019, and open “centralized provisioning depository accounts” in the branch of the People’s Bank of China where the legal person is located |

|

Regulation on the Supervision and Administration of Non-Banking Payment Institutions |

2023.12.09 |

The document is the first administrative legislation in China’s payment industry, which raises the level of non-bank payment supervision and aims to comprehensively strengthen the supervision of non-bank payment institutions |

Since 2010, with the rapid development of e-commerce and mobile payment, the central bank has issued relevant regulatory legislations, issuing a large number of licenses to encourage the development of the non-bank payment industry and officially including non-bank payment institutions into the regulatory framework. The number of users of non-bank payment institutions continues to grow due to the convenience they offer, and as a result an increasing amount of customer information is being concentrated on these platforms, but there are significant vulnerabilities in the management of customer information by non-bank payment institutions compared to experienced and regulated traditional banks. As a result, regulators are gradually strengthening this aspect of supervision to protect customer information security. The central bank stopped issuing new licenses after 2015, and at the same time, introduced more strict rules to regulate the development of the industry, with a particular focus on the safety of customer funds and the security of personal information (Junwen et al., 2019).

After decades of development, China has established a payment and clearing system centered on the central bank’s payment and clearing system, with the joint participation of commercial banks, clearing agencies and non-bank payment institutions, which is widely accessible and efficient. China has implemented an institutional regulatory model in the field of third-party payments, but with the development of Internet finance, the boundaries between various financial and non-financial institutions are gradually becoming ambiguous, and the drawbacks of the institutional regulatory model are gradually becoming apparent. In 2023, State council issued “Regulation on the Supervision and Administration of Non-Banking Payment Institutions”, which is the first administrative legislation in China’s payment industry. The content of the regulation mainly includes four aspects: (a) to clarify the definition of non-bank payment institutions and the licensing of their operation; (b) to improve the regulations on payment services; (c) to protect the legitimate rights and interests of users; and (d) to clarify the supervisory responsibilities and legal liabilities. The document provides a clearer definition of the rights and obligations of all parties in the payment industry, and enables the supervisory authorities to exercise their administrative functions in accordance with the regulatory framework3.

2. Risks Related to Third-Party Payments

2.1. Inadequate regulation

Third party payment sector is regulated by the People’s Bank of China. However, due to its issuance of departmental regulations, the legal status of regulatory regulations is low. This limits the strength of its regulation. This leads to inadequate supervision and regulatory loopholes. In the regulatory system, there is the problem of common supervision by multiple departments, which leads to poor coordination among regulatory departments and unclear regulatory responsibilities. In addition, the lack of uniform standards and norms for supervision makes it difficult to effectively regulate the third-party payment industry (Ding, 2021).

Secondly, compared with the traditional financial industry laws and regulations system, third-party payment as a new industry, rapid development. Targeted special laws and regulations are still scarce and lagging behind. Although China has promulgated a «Management Measures» to make specific provisions on the access and supervision of third-party payment, it cannot meet the rapid development of Internet technology and the large-scale use of third-party payment, which has led to the emergence of a variety of risk issues. It is impossible to prevent legal problems arising in the third-party payment industry in a timely manner, and there are still a large number of gaps in supervision (Liu Jin, 2018). At the same time, there are also some gaps and shortcomings in the third-party payment regulatory rules in cross-border payment, risk prevention, user information protection, which makes it difficult to fully protect the rights and interests of users. Especially in cross-border payment, the regulatory regulations are weak and difficult to regulate, and it is easy to have capital outflow and security loopholes.

2.2. Financial risk

Sinking fund risk. Sinking funds refer to unused idle funds in society. As an intermediary between buyers and sellers, the third-party payment platform does not have the ownership of the funds during the whole transaction process, but with the continuous growth of the transaction scale, the amount of funds deposited on the third-party payment platform becomes very huge (Ding, 2021). As China’s largest third-party payment platform, Alipay holds a large amount of funds that have not yet been timely transferred to the counterparty’s account, and this large amount of funds is temporarily stagnated in the Alipay system. The flow of large amounts of funds may be exploited by some speculators to engage in malicious market manipulation and cause abnormal market volatility. At the same time, the flow of a large amount of money may create pressure on the market and affect market stability.

Cash-in disorder. Alipay relies on network electronic information technology, but due to the virtual nature of the network, some users may maliciously use fake transactions to cash out. This compromises users’ personal information and causes losses to users’ private property (Xiong, 2023).

2.3. Technology risk

With the rapid development of technology, hacker attacks, data leakage and other security issues are becoming increasingly serious. If the technical protection measures of online payment companies are not in place, they may suffer serious security incidents, resulting in consequences such as leakage of user information and theft of funds. In addition, technological upgrades may also pose a challenge to online payment companies, e.g., the application of new technologies may require companies to invest a large amount of money in upgrading and transformation, while technological failures may lead to difficulties for companies. Third-party payment platforms have the commonality of survival based on financial technologies, operational risks in the fintech sector also exist in these payment platforms based on the functioning of fintech (Xu et al., 2020; Yao & Li, 2022; Huang et al., 2024).

3. Recommendations on Enhancing the Effectiveness of Third-Party Payment Regulation

3.1. Establish a comprehensive legal framework

Continuously improve the laws and regulations on third-party payment, clarify the responsibilities and obligations of all parties, and provide legal guarantees for the safe and stable development of the payment market. Establish a unified third-party payment regulatory authority to specifically supervise the field, ensure the compliance of third-party payment institutions and punish violations. Update laws and regulations on third-party payment in a timely manner to ensure that there is a law to follow (Ding, 2021).

3.2. Supervision of funds

The regulatory authorities will be responsible for the supervision of third-party payment institutions regarding the clearing, custody, and risk management of their activities. A firewall will be established between the deposited funds and the operating funds, and different financial institutions will be selected for specialized supervision to prevent misappropriation of funds (Zhang, 2018; Zhu, 2024). In strengthening the management of reserve funds, it is necessary to clarify the legal ownership of the precipitated funds and the fruits thereof, and to strictly control and screen the investment fields and investment directions of the precipitated funds, curb money laundering, and strive to establish and improve the relevant legal supervision system.

The use of funds is strictly in accordance with the Bank’s audit procedures to improve the management of deposited funds. Second, third-party payment institutions are required to keep users’ funds in separate accounts from their own funds, and conduct regular inspections and reports to ensure the safety of funds and the smooth operation of clearing. At the same time, regulators will also review and guide third-party payment institutions on risk management and contingency plans to ensure that risks can be dealt with in a timely manner when they arise, so as to safeguard the stability and security of the market.

3.3. Technical assurance

The technical systems of third-party payment institutions are monitored and audited to ensure that their systems are stable, reliable, secure and efficient. At the same time, regulators may also use encryption technology to protect user information to ensure that it is not illegally accessed or misused (Xu et al., 2020; Yao & Li, 2022).

Third-party payment plays an important role in e-commerce, and the government should strengthen supervision and establish an appropriate regulatory system to protect consumers’ rights and interests. Regulatory authorities should strengthen the formulation and adjustment of regulatory policies, improve the regulatory system and unify the market order. Third-party payment platforms must unswervingly strengthen internal risk control management, actively introduce new technologies. Make every effort to create a safe and reliable network environment, thereby effectively guaranteeing the safety of funds. Only under the premise of achieving security, stability and compliance can third-party payment achieve healthy, stable and comprehensive development and play an important role in the e-commerce ecosystem.

Conclusion

Third-party payments have had a markedly beneficial impact on economic and social development. Third-party payment has become an essential part of e-commerce, effectively solving the problems of high cost and lack of credit in e-commerce. The rapid development of third-party payments poses significant regulatory challenges. The financial innovation of third-party payment is bound to bring a lot of payment risk problems. Therefore, it is necessary to seriously summarize, review and study the current status of the development and regulation of third-party payment in China, so as to provide practical evidence for the implementation of effective regulation. The regulation of third-party payment should be scientific, rigorous and effective. The construction of the regulatory framework requires multi-dimensional considerations, meeting regulatory requirements to ensure standardized operation and laying the foundation for the stable development of the industry; focusing on the future to leave space for innovation and promote the progress of the industry; attaching importance to risk control and establishing a sound prevention and control system; protecting the sustainability of innovation and encouraging reasonable innovation; at the same time, safeguarding the rights and interests of payers and consumers and protecting their legitimate rights and interests. On the premise of safety, stability and compliance, it is urgent to promote the standardized and orderly development of the third-party payment sector, which is crucial to precisely controlling risks and guaranteeing the stability of the payment sector.

1. Market share of leading third-party online payment providers in China in 3rd quarter of 2023. Statista. https://clck.ru/3MEJeK

2. Ibid.

3. Regulation on the Supervision and Administration of Non-Banking Payment Institutions. Order No. 768 of the State Council of the People’s Republic of China. (2023, September 12). Chinalawinfo. https://clck.ru/3MEJjF

References

1. Chen, W., & Wang, X. (2024). Can mobile payment innovation contribute to low-carbon sustainable economic development? Spatial econometric analysis based on Chinese city-level data. Cities, 155, 105425. https://doi.org/10.1016/j.cities.2024.105425

2. Ding, Jie (2021). Legal Issues of Third-Party Payment in the Context of Internet Finance. Dispute Settlement, 7(4), 169–178. https://doi.org/10.12677/DS.2021.74022

3. Du, S. (2025). More to give in marriage? County-level sex ratios and marriage payments in China. Social Science Research, 127, 103141. https://doi.org/10.1016/j.ssresearch.2025.103141

4. Fan, X., Zhao, W., Zhang, T., & Yan, E. (2023). Mobile payment, third-party payment platform entry and information sharing in supply chains. Annals of Operations Research, 329, 353–372. https://doi.org/10.1007/s10479-020-03749-8

5. Huang, Z., Wang, L., & Yu, W. (2024). Financial development, electronic payments, and residents’ consumption: Evidence from rural China. Finance Research Letters, 71, 106455. https://doi.org/10.1016/j.frl.2024.106455

6. Junwen, Zh., Jianwei, D., & Ming, G. (2019). Objectives and institutional arrangements of third-party payment supervision – International comparison and policy recommendations. Financial Regulation Analysis. 03.006. https://doi.org/DOI:10.13490/j.cnki.frr.2019.03.006

7. Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35–46. https://doi.org/10.1016/j.bushor.2017.09.003

8. Liu Zhaolu. (2018). China’s third-party electronic payment model, 33. 029. Northeast Agricultural University.

9. Liu, J., Li, X., & Wang, S. (2020). What have we learnt from 10 years of fintech research? A scientometric analysis. Technological Forecasting and Social Change, 155, 120022. https://doi.org/10.1016/j.techfore.2020.120022

10. Liu, Jin. (2018). The Regulatory Model of Non-Bank Payment Institutions in China and International Comparison. Research report. Institute for Fintech research Tsinghua university.

11. Qiu, W. (2025). Does Mobile Payment Adoption Increase Household Portfolio Diversification? Evidence from China. Finance Research Letters, 75, 106911. https://doi.org/10.1016/j.frl.2025.106911

12. Tang, Y. M., Chau, K. Y., Hong, L., Ip, Y. K., & Yan, W. (2021). Financial innovation in digital payment with WeChat towards electronic business success. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1844–1861. https://doi.org/10.3390/jtaer16050103

13. Thakor, A. V. (2020). Fintech and banking: What do we know? Journal of Financial Intermediation, 41, 100833. https://doi.org/10.1016/j.jfi.2019.100833

14. Xiong, Cen. (2023). China’s third-party payment risk and control suggestions, E-commerce, 6.

15. Xu, R., Mi, C., Mierzwiak, R., & Meng, R. (2020). Complex network construction of Internet finance risk. Physica A: Statistical Mechanics and its Applications, 540, 122930. https://doi.org/10.1016/j.physa.2019.122930

16. Yao, M., Di, H., Zheng, X., & Xu, X. (2018). Impact of payment technology innovations on the traditional financial industry: A focus on China. Technological Forecasting and Social Change, 135, 199–207. https://doi.org/10.1016/j.techfore.2017.12.023

17. Yao, Y., & Li, J. (2022). Operational risk assessment of third-party payment platforms: a case study of China. Financial Innovation, 8, 19. https://doi.org/10.1186/s40854-022-00332-x

18. Ye, W., Chen, W., & Fortunati, L. (2023). Mobile payment in China: A study from a sociological perspective. Journal of Communication Inquiry, 47(3), 222–248. https://doi.org/10.1177/01968599211052965

19. Zhang, Z. (2018). Law and economic growth in China: a case study of the stock market. Asian Journal of Law and Society, 5(2), 333–357. https://doi.org/10.1017/als.2018.17

20. Zhao, X., & Sun, Y. (2012). A study of third-party online payment: Risk control and supervision analysis. WHICEB 2012 PROCEEDINGS. 95.

21. Zhu, Jing. (2024). Research on Legal Supervision Issues of Third-Party Payment. E-commerce Letters, 13(1), 44–49. https://doi.org/10.12677/ecl.2024.131006

About the Authors

L. JingrongChina

Li Jingrong – Bachelor student, Faculty of International Education

Address: 4 Wei Le Avenue, 730101, Lanzhou, China

Sh. Jigeer

Russian Federation

Shawuya Jigeer– PhD student, Assistant, Graduate School of Industrial Economics

Address: Polytechnicheskaya St, 29, 195251, Saint Petersburg, Russia

Scopus Author ID: https://www.scopus.com/authid/detail.uri?authorId=57236746000

WoS Researcher ID: https://www.webofscience.com/wos/author/record/HLG-6496-2023

Google Scholar ID: https://scholar.google.com/citations?user=ilwN9hAAAAAJ

- Third-party payments, which have become an integral part of e-commerce in China, have a market structure of “2+1+N” model with Alipay and WeChat Pay as dominating payment platforms;

- Three main categories of risks are insufficient legal regulation, financial risks, and technological risks;

- There is a need to create a comprehensive legal framework and a single regulator for the third-party payments sector;

- It is recommended to strengthen the supervision of deposited assets and to introduce specialized technical measures for user information protection.

Review

For citations:

Jingrong L., Jigeer Sh. Third-Party Payment Regulation: Analysis of Risks and Legal Mechanisms in China. Journal of Digital Technologies and Law. 2025;3(2):259-274. https://doi.org/10.21202/jdtl.2025.11. EDN: kxekjy